Introduction

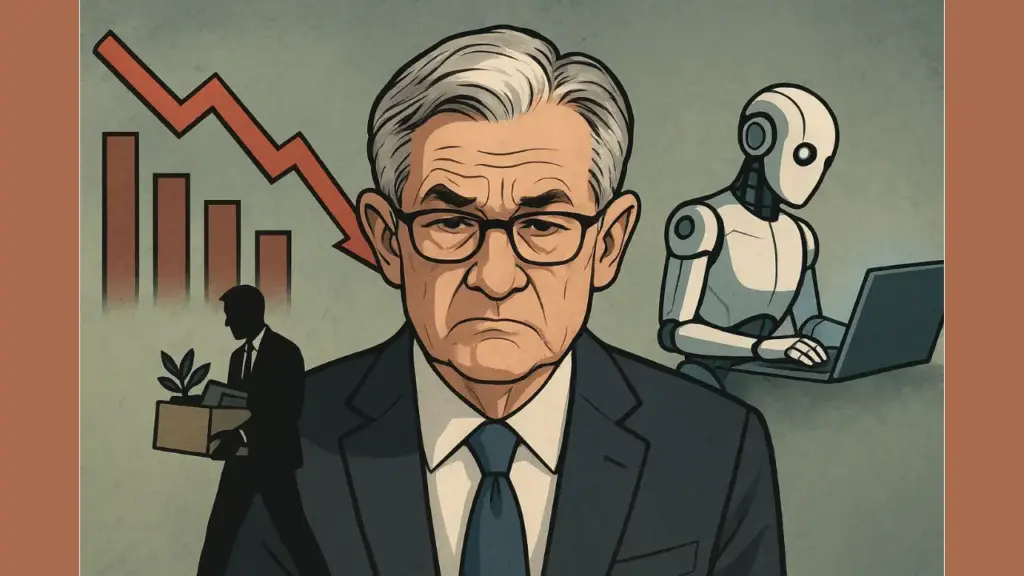

The U.S. economy has been under pressure since the Federal Reserve raised interest rates to combat inflation. Fed Chair Jerome Powell has held rates high for longer than expected. His policies are shaping the tech sector in unexpected ways.

Since 2022, more than 500,000 tech jobs have disappeared. Layoffs hit startups, mid-sized firms, and even tech giants. Many point to artificial intelligence (AI) as the main cause. But is AI really the villain? Or are high borrowing costs the hidden reason behind this wave of job losses?

This blog breaks down the connection between Powell’s monetary policy, rising interest rates, and the tech industry’s struggles. It also shares strategies for job seekers navigating this unstable market.

The State of the Tech Job Market

Tech was once considered a safe haven for growth and innovation. That perception changed after 2022. Companies that were once hiring aggressively began slashing roles.

Reports show over half a million layoffs in the industry since the start of 2022. Major firms like Meta, Amazon, and Google have all announced large-scale job cuts. Startups, once seen as engines of innovation, now struggle to survive.

The narrative from many employers is simple: AI is reshaping the industry. Executives claim automation and machine learning make some roles redundant. While true in some cases, this explanation hides deeper financial pressures.

High Interest Rates: The Hidden Culprit

The real weight on tech isn’t just AI — it’s borrowing costs. The Fed’s sustained high interest rates have made raising capital extremely expensive.

Startups rely heavily on investor money. Venture capital funds shrink when borrowing is costly. Without affordable loans or strong funding rounds, these companies cannot expand. Many cut jobs to stretch limited resources.

Big tech isn’t immune either. Companies like Microsoft and Alphabet thrive on global expansion and bold bets. But when interest rates climb, even cash-rich firms slow down. Debt becomes expensive. Expansion plans pause. Budgets shrink.

As a result, jobs vanish. Projects stall. Innovation slows. High interest rates act as a brake on the entire tech ecosystem.

Is It Politically Motivated?

Another question lingers: is Powell’s policy purely economic, or does politics play a role?

The Federal Reserve insists that rate hikes are necessary to control inflation. Yet critics argue the prolonged tightening hurts workers more than it helps. Some suggest the Fed is leaning too far in its attempt to cool the economy.

The timing also raises eyebrows. Keeping rates high through election cycles impacts how the public feels about the economy. Layoffs in high-visibility industries like tech grab headlines. The broader message becomes one of instability, even if inflation metrics improve.

Whether intentional or not, the Fed’s actions shape political narratives. Tech workers, unfortunately, become collateral damage in the process.

AI as the Convenient Scapegoat

Artificial intelligence makes a convenient cover story. Companies frame layoffs as part of a “future-focused” transition. Leaders announce efficiency gains through automation, making it appear progressive rather than defensive.

But in reality, AI has not yet replaced hundreds of thousands of workers. Most AI systems require human oversight and skilled operators. The sudden layoffs are less about new technology and more about reduced budgets.

AI is the perfect excuse. It distracts from the financial strain high interest rates cause. It also reassures investors that companies are aligning with the “AI wave” to boost market confidence.

The truth is simpler: AI is real, but it’s not the primary reason for mass job cuts. High borrowing costs drive most of the painful decisions.

Impact on Job Seekers and Workers

The fallout is devastating for workers. Skilled developers, designers, and engineers face an uncertain future.

Job postings have slowed. Competition for open roles has intensified. Many find that salaries are lower than before. Employers now hold the advantage in negotiations.

The emotional toll is heavy too. Workers who once believed in the stability of tech feel betrayed. Anxiety about job security is widespread. For many, career paths once thought secure now look shaky.

This is not just about employment numbers. It is about confidence in the future of work. When one of the most innovative sectors struggles, it signals deeper problems in the economy.

Strategies for Job Seekers

Despite the challenges, opportunities exist. Tech professionals can adapt and thrive with the right approach.

1. Upskill for AI and Automation

Instead of fearing AI, learn to work with it. Skills in machine learning, prompt engineering, and data science are in demand.

2. Explore Non-Traditional Tech Roles

Healthcare, energy, and finance all need tech expertise. Transitioning into these industries opens new doors.

3. Consider Freelancing and Fractional Roles

The rise of the fractional CTO model shows how companies hire top-level expertise without committing to full-time costs. Tech leaders can position themselves as consultants, helping multiple startups simultaneously.

4. Build a Strong Network

Networking is more critical than ever. Building relationships across industries creates more opportunities than relying on job boards alone.

5. Stay Flexible

Remote work, contract projects, and hybrid models continue to grow. Flexibility increases chances of finding rewarding roles.

By focusing on adaptability and continuous learning, job seekers can reduce the risks of economic shifts.

What Lies Ahead for Tech and the Economy

The future depends heavily on the Fed’s next moves.

If high interest rates remain, layoffs may continue. Startups will struggle to raise funds. Big tech will slow down on ambitious projects. Innovation could stall.

If rates fall, capital will flow more freely. Startups will revive. Hiring could bounce back. Innovation may accelerate once again.

In either scenario, AI will remain part of the conversation. The difference lies in whether companies use it as a genuine driver of growth or a convenient excuse for financial struggles.

Policymakers, investors, and leaders must balance inflation control with the need to sustain innovation. The tech industry thrives on risk-taking. Too much economic tightening chokes its lifeline.

Conclusion

The tech industry’s layoffs are not just about artificial intelligence. High interest rates play a major role in shrinking budgets and limiting growth. Jerome Powell’s monetary policy has triggered a chain reaction, forcing companies to cut jobs and rethink strategies.

For job seekers, the path forward requires adaptability. Upskilling, exploring new industries, and considering roles like a fractional CTO can provide stability in uncertain times.

The key question remains: are these policies a necessary correction, or are they crippling innovation? Only time will tell.

What is certain is that tech workers, startups, and innovators must stay resilient. The story of tech has always been about bouncing back. And as platforms like StartupHakk remind us, disruption often creates the best opportunities for growth.